Home-Based Care Public Company Roundup Q3 2024

- Emin Beganovic

- Nov 19, 2024

- 8 min read

Updated: Apr 7

Mertz Taggart follows the publicly traded home-based care companies and reports on their earnings calls each quarter. As a group, public company performance and share price serve as a proxy for industry performance and investor sentiment, respectively. Historically seen as the “ultimate consolidators”, the publicly traded home-based care trading multiples have a downstream effect on lower middle market home-based care M&A.

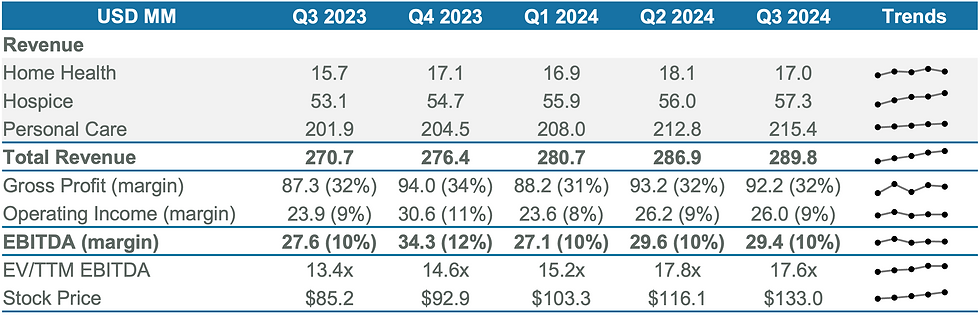

Addus Homecare (Nasdaq: ADUS)

Highlights

Addus delivered strong operating results in Q3 2024, with total revenue increasing by 7% to $289.8 million from $270.7 million in Q3 2023. This growth was driven by a combination of solid organic expansion and contributions from recent acquisitions.

The personal care segment, representing 74% of total revenue, experienced 6.7% organic growth in Q3 2024 compared to Q3 2023, driven by strong demand and favorable reimbursement across its markets. In the Q3 2024, the company hired 79 personal care caregivers per business day, while turnover rates remained historically low.

The hospice and home health segment's revenue growth was primarily driven by the 2023 acquisition of Tennessee Quality Care. The hospice segment’s average daily census grew modestly to 3,534 in Q3 2024, a 2.3% increase from 3,453 in Q3 2023.

The Company maintained a stable gross profit margin of 32%, consistent with the levels reported in both Q3 2023 and Q2 2024.

Key Financial Figures

M&A Activity

Addus is moving forward with the acquisition of Gentiva’s personal care business to strengthen the scale of its personal care segment. As Addus CEO Dirk Allison noted, “upon the close of this transaction, Addus will be the largest provider of personal care services in the state Texas, which is primarily a managed Medicaid market. In addition, this transaction will give us a larger presence in Arkansas, strength our California and Arizona private pay and Veterans Affair businesses and will add a location in Eastern Tennessee to our existing operations in the state and provide entry into both Missouri and North Carolina.”

ADUS expects the Gentiva acquisition to close in fourth quarter and will add $280 million in annualized revenues in personal care services.

On May 21, 2024, the company agreed to sell its New York operations to HCS-Girling for up to $23 million, with the transfer contingent on regulatory approvals.

Guidance

Addus expects a positive impact on the personal care segment from favorable reimbursement rates across its operating states. Starting January 1, 2025, Illinois, the largest state for personal care services, will implement a 5.5% rate increase.

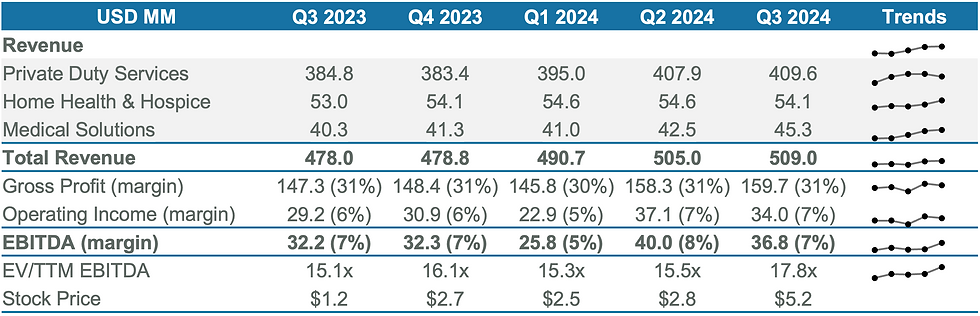

Aveanna Healthcare (Nasdaq: AVAH)

Highlights

Revenue for Q3 2024 totaled $509 million, reflecting a 6.5% increase compared to Q3 2023. Aveanna achieved year-over-year growth across all three operating divisions, with Private Duty Services increasing 6.4%, Medical Solutions rising 12.6%, and Home Health & Hospice growing 2.2% compared to the same period in 2023.

EBITDA for the quarter was $36.8 million, representing a 14.3% increase year-over-year. This growth was primarily driven by strong performance in its private duty division, an improved payor rate environment, the successful implementation of cost reduction initiatives, and focus on episodic payers within its home health division.

Aveanna recognizes that the primary challenge is the labor environment, particularly the shortage of available caregivers. In the past quarter, the company has seen notable improvements in caregiver hiring and retention trends, positively impacting its financial performance.

Organic growth across all segments compared to the prior year: Private Duty hours grew 3.8%, Home Health & Hospice episodes grew 1%, and Medical Solutions had a 4.5% increase in unique patients served.

Key Financial Figures

M&A Activity

Aveanna CEO Jeff Shaner stated, “We feel like we have not only stabilized the company but put the company back on the rightful path for growth and success. And we believe it’s time for us to reenter the M&A market.”

The company plans to close transactions in 2025, focusing on acquisitions within the Private Duty Nursing and Home Health & Hospice segments as part of its inorganic growth strategy.

Guidance

Aveanna expects to continue the momentum into 2025.

Year-to-date, Aveanna has secured 12 state rate increases for Private Duty Services, with additional states expected to implement increases in early 2025.

In addition, the Company is in the early stages of implementing the preferred payer strategy in Medical Solutions to be fully realized by the end of 2025

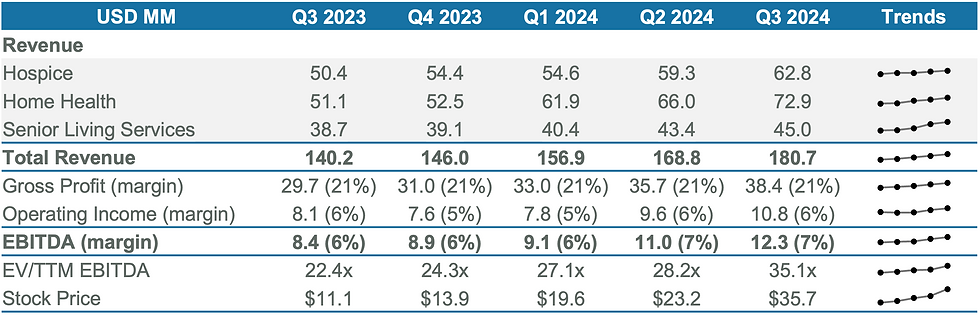

The Pennant Group, Inc. (Nasdaq: PNTG)

Highlights

For Q3 2024, the company reported total revenue of $180.7 million, an increase of $40.5 million or 28.9% compared to Q3 2023. The company has invested in leadership, increased occupancy, improved revenue quality, and enhanced operational performance to drive this growth.

The Home Health segment continued to show strong growth, with quarterly revenues reaching $72.9 million, a 43% increase year-over-year. Total home health admissions increased by 38.5%, while Medicare home health admissions increased by 30.8%.

The Hospice segment achieved a 25% increase in revenue year-over-year, supported by improvements in hospice programs and the successful integration of recent acquisitions, which have helped differentiate its operations within the community. Hospice admissions increasing by 22.8%.

The Senior Living segment generated $45 million in revenue, representing a 16.3% increase over the prior year quarter.

Key Financial Figures

M&A Activity

In August, PNTG completed the first phase of its $80 million planned acquisition of Signature Group, LLC operations (Washington and Idaho assets). This acquisition added four home health agencies and one hospice agency to the Company’s portfolio. According to PNTG’s President & COO, John Gochnour, “The integration and transition of these operations is proceeding well, and we are starting to unlock additional value by implementing our unique operating model, sharing best practices, and providing world-class support from our service center.”

The Oregon assets of Signature represent the second and larger portion of the transaction, with preparations for closing on January 1, 2025.

Guidance

Considering the company’s geographic distribution and the finalized wage index updates, Pennant anticipates a net neutral effect on per-episode reimbursement under the 2025 Final Rule.

PNTG has raised its full-year 2024 guidance as follows: total revenue between $665.3 million and $706.5 million, adjusted earnings per diluted share between $0.90 and $0.96, and adjusted EBITDA between $51.9 million and $55.2 million. This guidance update reflects strong expected performance through year-end, hospice reimbursement adjustments, lower interest expenses, and contributions from joint ventures and management agreements.

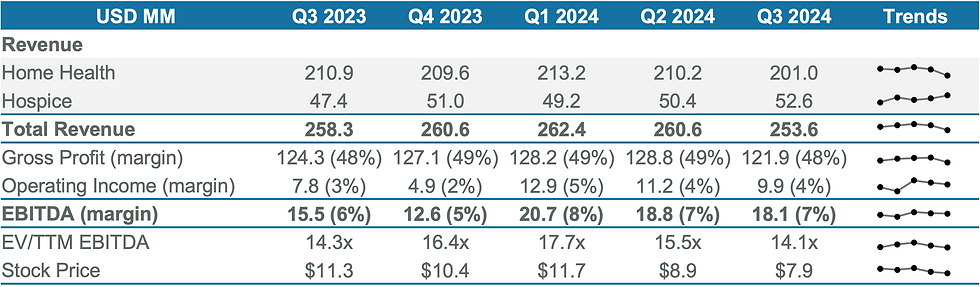

Enhabit Home Health & Hospice (Nasdaq: EHAB)

Highlights

Enhabit total revenue was $253.6 million for the third quarter down $4.7 million or 1.8% year-over-year. EBTIDA was $18.1 million up $2.6 million or 16.8% year-over-year. EBITDA still lower than Q1 2024, and Q2 2024.

Home Health revenue declined by $9.9 million. Non-Medicare admissions grew 20.1%, driving total admissions growth of 5.6% year-over-year. Of these non-Medicare visits, 45% are now under payor innovation contracts at improved rates. However, while admissions grew, recertifications declined due to more admissions from acute care facilities with shorter stays and a changing payor mix in congregate living settings. This drop in recertifications was the main factor in the revenue decrease.

Hospice revenue grew by $5.2 million or 11% year-over-year, driven by higher patient days and improved reimbursement rates. Since January 2024, the average daily census has risen monthly, with a 6.9% increase in Q3, including 5% same-store growth.

Key Financial Figures

M&A Activity

The company remains limited by its credit agreement, which restricts acquisition opportunities due to current debt levels. As Enhabit Senior Vice President and Treasurer Jobie Williams stated, “We have focused this year on accelerating cash and paying down debt, and our success can be seen in our results. Our leverage decreased for the third quarter in a row. We ended the third quarter with a leverage ratio of 4.8 times.”

Guidance

Enhabit has revised its 2024 guidance due to lower recertifications in Q3 and the impact of hurricanes. In Q3, 29 home health branches were affected by Hurricane Helene, and 21 by Hurricane Milton, with 12 impacted by both, resulting in an estimated loss of 425 to 450 admissions.

The revised full-year revenue forecast for 2024 is $1.031 billion to $1.046 billion, with adjusted EBITDA expected between $98 million and $102 million. Starting October 1, 2024, the hospice segment received a 4% reimbursement rate increase, expected to generate an additional $8 million annually. For home health, 2025 revenue is projected to grow by low- to mid-single digits, driven by admissions, census growth, and a shift to higher-paying Medicare Advantage plans. This growth is also supported by a continued focus on operational efficiency.

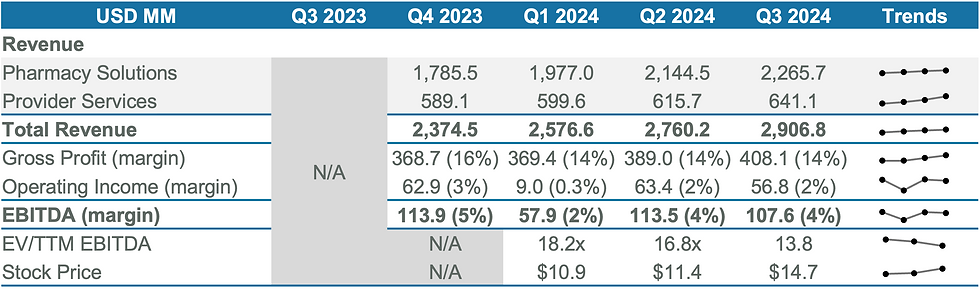

BrightSpring Health Services, Inc. (NASDAQ: BTSG)

Highlights

BTSG total revenue in Q3 2024 was $2.9 billion, representing 29% growth from the prior year period.

Pharmacy Solutions segment revenue was $2.3 billion, achieving growth of 35% year-over-year. Within the segment, Infusion and Specialty revenue was $1.7 billion, reflecting a 42% increase compared to last year. And home and community pharmacy revenue was $588 million, marking growth of 19% year-over-year.

The Provider Services segment had revenue of $641 million, representing growth of 10% compared to the prior year period. Home health contributed $265 million, growing 13%, with average daily census rising 16% to over 46,000. This growth was driven by strong clinical quality, including 30-day readmission rates that are 60% lower than the national average, particularly notable in the company’s emerging primary care services. Community and rehab care revenue was $376 million, representing growth of 8% year-over-year.

Gross profit increased across all segments compared to Q3 of last year. Adjusted EBITDA reached $151 million, reflecting a 16% year-over-year growth.

Key Financial Figures

M&A Activity

During the nine months ending September 30, 2024, BTSG completed seven acquisitions across its Pharmacy Solutions and Provider Services segments, aimed at expanding its services and geographic reach.

On September 1, 2024, BTSG announced the acquisition of North Central Florida Hospice, Inc. ("Haven Hospice"), which provides hospice and palliative care services throughout Florida. As CEO Jon Rousseau stated, “Towards the end of the third quarter, we announced the closing of the Haven Hospice acquisition, and we look forward to expanding our quality care to high-need patients in Florida. Our hospice business continues to show strong growth, with excellent patient satisfaction, currently holding an 84% overall care rating according to the Consumer Assessment of Healthcare Providers and Systems.”

Guidance

BTSG has revised its revenue and Adjusted EBITDA guidance for the full year 2024 as follows:

Revenue: Increased to a range of $11.0 billion to $11.3 billion

Adjusted EBITDA: Revised to a range of $580 million to $585 million, reflecting anticipated growth of 14.2% to 15.2% compared to 2023.

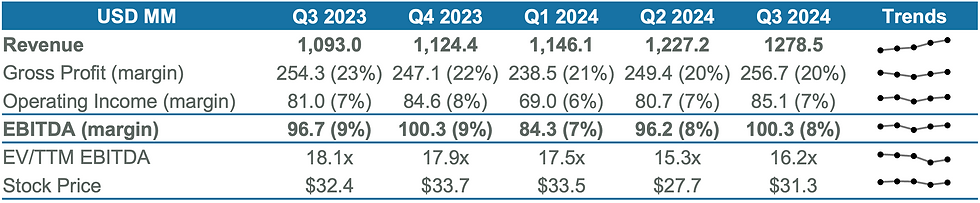

Option Care Health, Inc. (NASDAQ: OPCH)

Highlights

OPCH reported Q3 2024 revenue of $1,278.5 million, a 17% increase from $1,093.0 million in Q3 2023, driven by strong growth in its rare and orphan portfolios and continued expansion in established therapeutic categories.

Gross profit was $256.7 million, or 20.1% of net revenue, up 1.0% from $254.3 million in Q3 2023. Gross profit continues to improve, and spending leverage is strengthening, with SG&A down nearly 1% year-over-year. Adjusted EBITDA reached $115.6 million, reflecting a 5.3% increase from $109.8 million in the same period last year.

While Hurricane Helene impacted operations in the Southeast at the end of Q3, it did not materially affect overall results.

Cash flow generation remains strong, with $160.4 million in cash flow from operations for the quarter. The company ended the quarter with cash balances of $483 million, after deploying approximately $42 million on share repurchases. As CFO Mike Shapiro stated, “We believe the balance sheet has never been stronger, and we remain engaged in a number of acquisition opportunities while continuing to execute our multifaceted capital deployment strategy.”

Key Financial Figures

M&A Activity

In Q2 2024, OPCH repurchased approximately $78 million of its stock. Given the strong momentum in cash flow generation, the company remains focused on deploying capital through M&A and share repurchase strategies. In Q3 2024, the company repurchased an additional $41.9 million of stock.

Guidance

Option Care Health has updated its financial guidance for the full year 2024, projecting:

Revenue: $4.9 billion to $4.95 billion

Adjusted EBITDA: $438 million to $443 million.

Supply chain disruptions from Hurricane Helene, especially in intravenous solution production, have significantly impacted operations. As a result, the company is currently limited in its ability to onboard new patients, particularly those requiring intravenous antibiotics and nutrition support therapy.

The company expects the supply situation to improve over the coming weeks and months as imports resume and production ramps up at plants and other producers. The updated guidance incorporates the IV bag supply chain disruption. The Company expects that the disruption will negatively impact the fourth quarter financial results and is considered in its updated 2024 guidance.

Comments