Q2 2021 Home Health, Hospice and Home Care M&A Update

- Admin

- Jul 14, 2021

- 5 min read

Updated: Mar 25

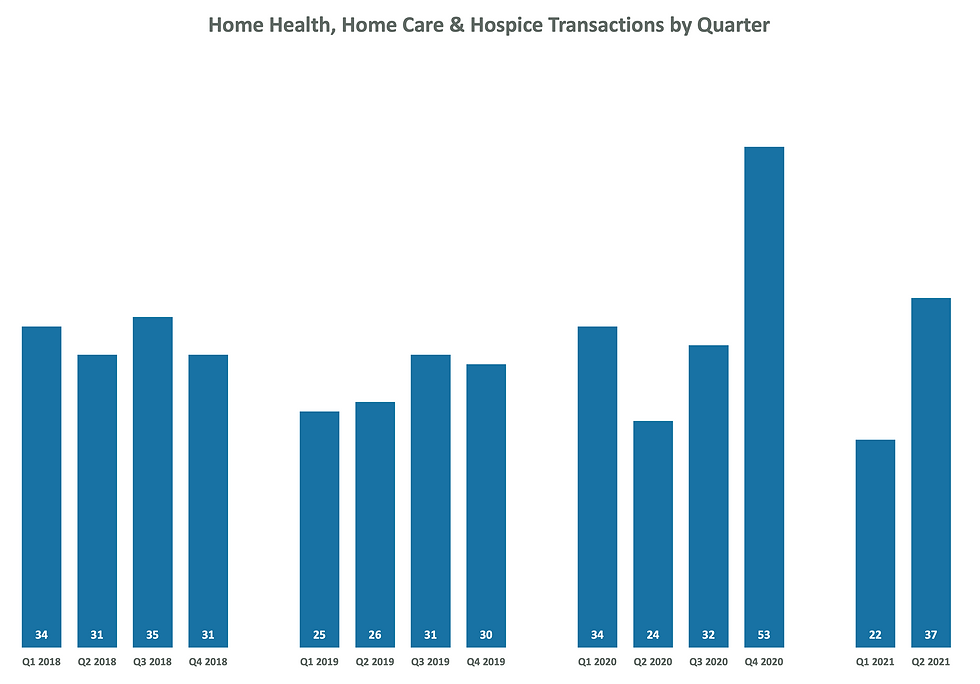

After dropping slightly in the first quarter of 2021, M&A activity for home health, hospice and home care rebounded significantly in Q2.

Overall, there were 37 transactions completed in the second quarter. That marked the largest number of deals in a quarter on record outside of Q4 of 2020, which saw a record-breaking 53 total.

“M&A activity ticked back up in a major way in the last quarter, as was expected,” Mertz Taggart Managing Partner Cory Mertz says. “Unfortunately, a lot of agency owners are burned out and thus looking to sell. The pandemic has undoubtedly taken its toll.”

It’s not just about burnt out agency owners, however. There are other reasons why 2021 has the chance to be one of the most significant dealmaking years ever.

Mertz sees two main causes. First is the spotlight that shone on these providers during the pandemic, which increased the value of many at-home care agencies nationwide. Second are recent tax legislation considerations.

The Biden-Harris administration has introduced a new tax bill that will have significant implications on transactions. The bill proposes moving the tax rate on long-term capital gains from 23.8% (including the 3.8% Medicare tax) to 43.4%, and if passed, would be expected to go into effect on Jan. 1, 2022.

Under the current 23.8% rate structure, a $10 million transaction would result in $7.62 million of after-tax proceeds. To net the same $7.62 million after taxes under the new proposed rate, a deal would require $13.46M million in cash proceeds.

“Sellers’ anticipation of an increase in the capital gains tax rate is something that is undoubtedly the biggest driver of the current market,” Mertz says.

Home-based care tailwinds derived from the pandemic will also continue to drive up the value of select agencies as the public health emergency wanes.

“I expect we’re going to see this kind of velocity and perhaps acceleration as we close out 2021, barring anything unforeseen,” Mertz says. “This is setting up to be another record year for the sector.”

As for the actual buyers, private equity (PE) players continue to lead the way, accounting for 24 of the 37 deals overall, including six (6) platform transactions.

Note: Total industry transactions does not necessarily equal the sum of the sub-industries, as many transactions include more than one sub-industry.

While PE remains a major player, health care providers looking to build out more substantial capabilities across the care continuum could become competitors in a buyers’ market.

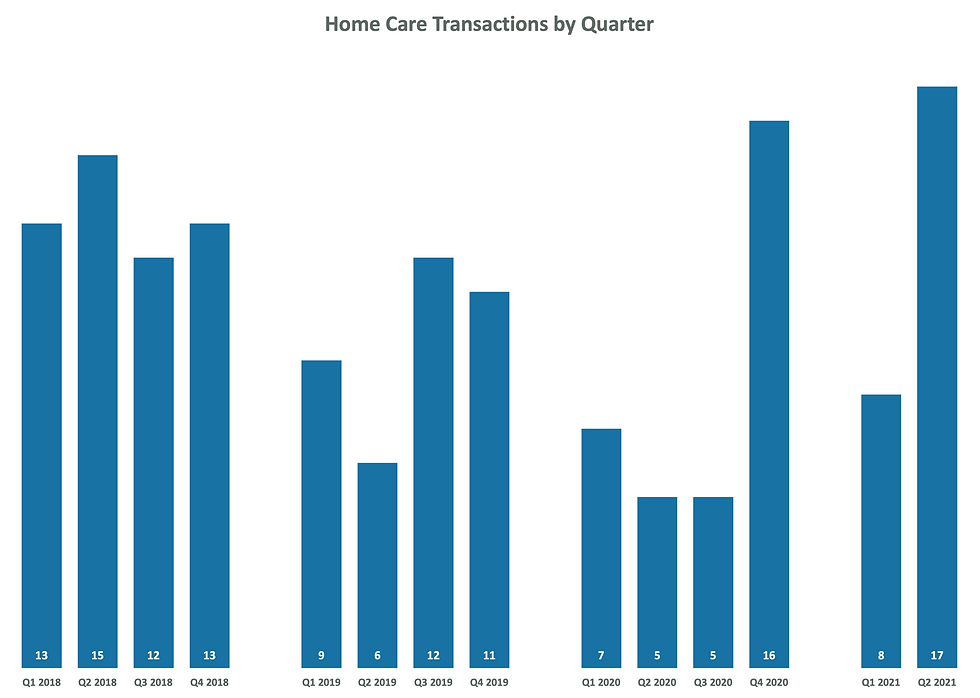

Home Care M&A Skyrockets

The deals made in the home care sector played a big part for the Q2 uptick. The parity between home care, home health and hospice is also an unusual detail of this quarter’s transaction numbers. One reason for that is the home care market — which had the most deals — heating up.

“Non-medical home care has become a hotter market,” Mertz says. “The 17 total non-franchise deals in Q2 were the highest number we’ve seen in home care in the last five years.”

Arosa — formerly known as Arosa+LivHome, and backed by Bain Capital Double Impact — continued a busy 2021 in Q2, acquiring the Tennessee-based Family Staffing Solutions. In Q1, the Los Angeles-based Arosa entered the New Jersey market following the acquisition of Aveanna Concierge Services.

Family Tree In-Home Care acquired HomeCare of the Rockies, aiming to take greater control of the private-pay market west of its Texas base — in states like Colorado.

Chicago-based Help at Home, a provider of home- and community-based services, is also rumored to be going public by the end of the year. If true, that reveals the immediate impact of Centerbridge Partners and The Vistria Group, which acquired Help at Home last November.

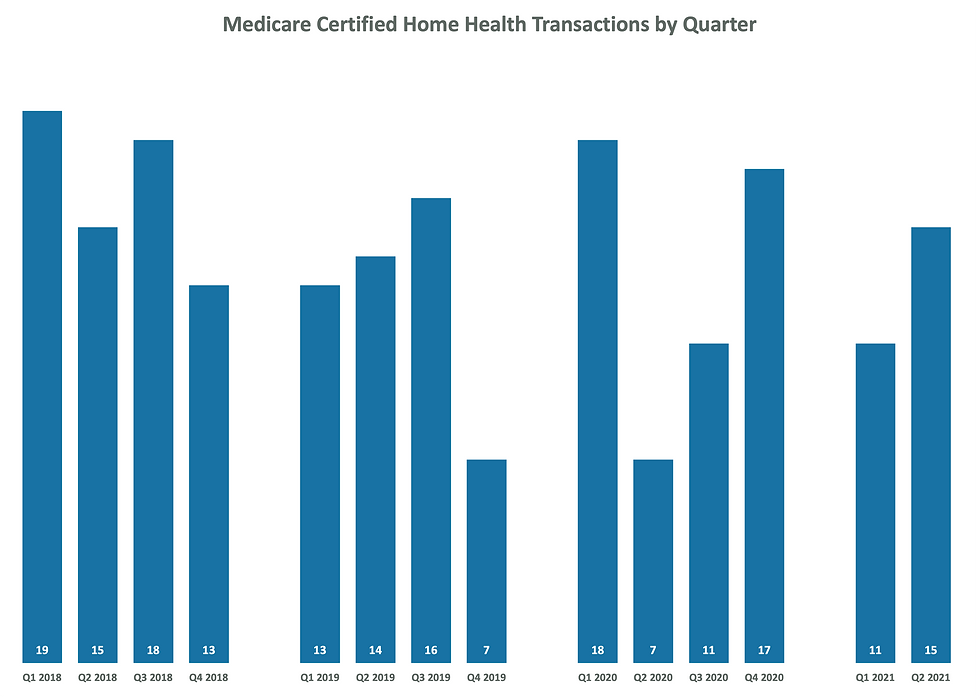

Home Health Agencies Get Aggressive

The 15 deals in home health during the second quarter were also underscored by some larger moves in the sector.

In May, home care provider Aveanna (Nasdaq: AVAH) went public, and also announced plans to become a player in the Medicare space by acquiring Doctor’s Choice Holdings, LLC for an aggregate cash consideration of $115 million.

“We believe that Doctor’s Choice is a perfect fit to our strategy because it deepens our penetration into the traditional home health market and brings us greater density in the state of Florida,” Aveanna Executive Chairman Rod Windley said in a statement. “Our pipeline of acquisition targets currently remains robust for traditional home health as well as private duty services.”

Going public is an exit strategy that a handful of other providers could be weighing, leveraging the valuations of the current public operators.

The home-based care provider that was the most active in Q2 was The Pennant Group (Nasdaq: PNTG) — parent company of affiliated home health, hospice, home care and senior living companies — which closed three deals, include Pasco Southwest in Colorado. Mertz Taggart provided exclusive transaction advisory services in this transaction, representing the seller.

Despite staffing pressures and other challenges tied to the COVID-19 pandemic, the Eagle, Idaho-based Pennant clearly sees the present as the right time to acquire. As more buyers come to market, prices will likely be less favorable, which bodes well for the companies getting into M&A earlier.

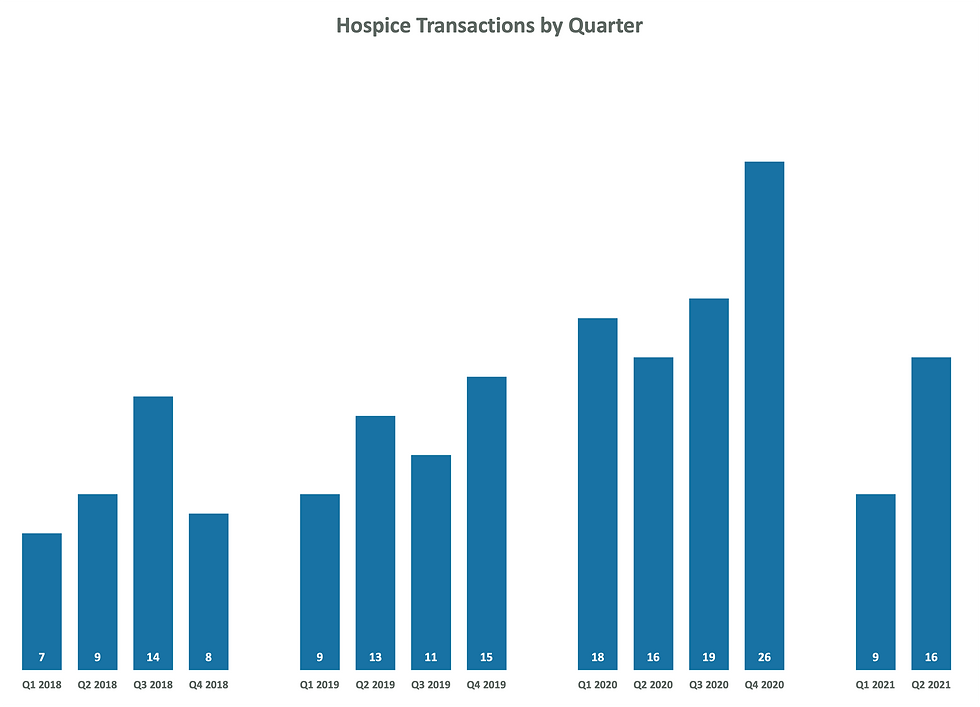

Hospice

Hospice dealmaking was in near lockstep in Q2 with the home health sector, totaling one more transaction, with 16.

“Demand is still very high in hospice, but there aren’t all that many options for buyers,” Mertz says. “Although there was still significant activity in Q2, I suspect it will level off and create more demand for home health and home care sellers in the near-term.”

Pennant was also active here, acquiring the Sacramento, California-based First Call Hospice in mid-June.

For companies like Pennant that provide care across the spectrum, having multiple capabilities such as home health and hospice in the markets they serve appears to be a key motivator.

LHC Group Inc. (Nasdaq: LHCG) was the most notable active player in hospice, acquiring Heart of Hospice, an end-of-life care provider with locations in five states, and Heart ‘n Home Hospice before that.

Overall, while 16 deals in the second quarter represented an increase from Q1, that number represents the lowest we’ve seen since Q2 2020, which also saw 16 deals.

Looking ahead

If 2021 is going to be a record-breaking year in M&A as predicted, it would point to a very busy second half of 2021.

After all, the year initially got off to a slow start with just 22 total deals in the first quarter. Between the first two quarters, 59 total deals have come to a head.

There were 82 total deals in 2017, 131 in 2018, 112 in 2019 and 143 in 2020.

Comments